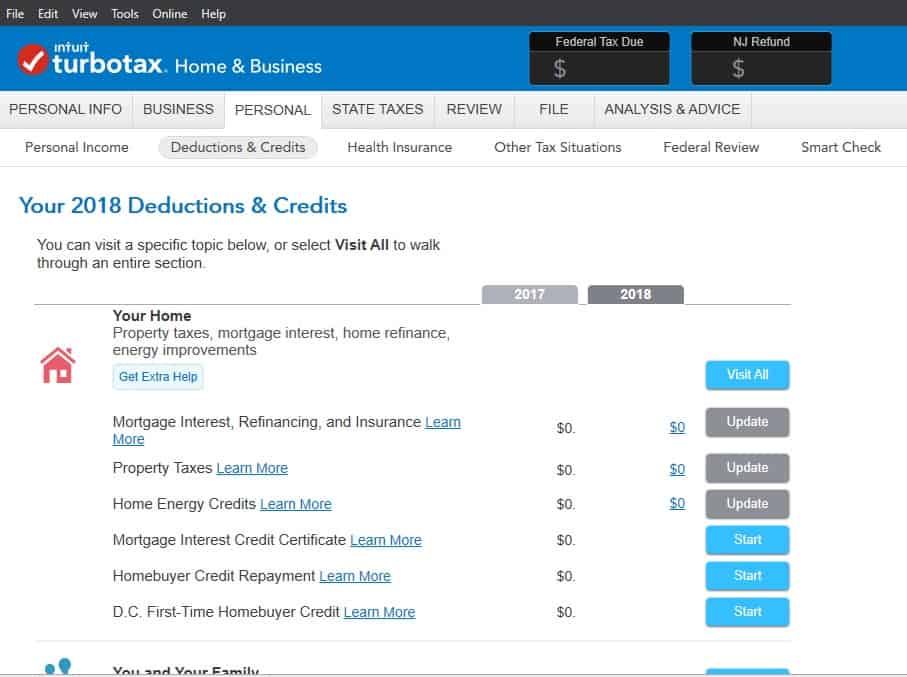

Tax payers who don't use a professional or online tax preparation service may not know what tax credits are available to them unless they read or follow tax-related news. Whichever way you choose, get your maximum refund guaranteed.Īre there tax credits you may have missed out on? Just answer simple questions, and we’ll guide you through filing your taxes with confidence. File your own taxes with confidence using TurboTax. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.

#2015 turbotax 1040x form not final do not file full

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. If not, then you must build time into your filing schedule to obtain a copy of your W-2 from your employer and any 1099 forms you're missing from your bank and other payers. If you kept your financial records, you have an easy ascent. One of the hills you have to climb to claim your refund is gathering the necessary documents.

If you have an unclaimed state tax refund, you’ll want to contact your state government’s tax department for the time limits for claiming your state refund.

This article outlines the timeline for claiming a refund from the IRS. Is the timeline for claiming a tax refund the same for state and federal taxes? Late filers who owe no taxes don't pay any penalty, and might even be eligible to get credits beyond the money withheld from their wages. The three-year countdown starts on the original due date of the return or the extension due date, if an extension was filed. The law gives procrastinators three years to submit a return and claim a refund. By not filing, many of these people risk losing any refund they're owed, which averages more than $600, according to Internal Revenue Service estimates.

Over a million Americans fail to file a tax return every year. How long do you have to claim your tax refund?

0 kommentar(er)

0 kommentar(er)